iowa inheritance tax rates 2021

Inheritance Tax Rates Schedule. Ad Subscribe a Plan for Unlimited Access to Over 85k US Legal Forms for just 8mo.

Effective July 1 2021 for decedents dying on or after January 1 2021 but before January 1 2022 the applicable tax rates listed in Iowa Code section 450101-4 are reduced by 20.

. In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. Though you wont owe a state-level estate tax in Iowa the federal estate tax may apply. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

Spouses children and even parents were already excluded from paying the inheritance tax while nieces. How do I avoid inheritance tax in Iowa. If you wish to avoid an inheritance tax you can ensure that the net estate is valued at less than 25000.

Schedule B beneficiaries include siblings half-siblings sons-in-law and daughters-in-law and the rate is 5 to 10. As part of the reform bill Governor Reynolds signed into law on June 16 2021 Iowas inheritance tax will be phased out over four years. Iowa Inheritance Tax Rates.

14 The inheritance tax is phased out in the following manner. Iowa was one of just six states in the country to still impose an inheritance tax. 40 East Broadway 59701 Butte 888-467-2669.

More-distant family members like cousins get no exemption and pay an initial rate of 15Inheritance tax usually applies in two cases. Register for a Permit. Inheritance taxes in Iowa will decrease by 20 per year from 2021 through 2024.

See General Instructions for Iowa Inheritance Tax Return IA 706. And in 2024 the tax rates below will be reduced by 80. As of early 2022 the exemption amount is 1206 million per personLegislation currently pending in Congress could change that limit if it becomes law.

In 2021 rates started at 108 percent while the lowest rate in 2022 is 116 percent. In 2021 the tax rates listed below will be reduced by 20. Inheritance Tax Rates Schedule.

Ad Download Or Email IA 706 More Fillable Forms Register and Subscribe Now. A summary of the different categories is as follows. Pursuant to the bill for persons dying in the year 2021 the Iowa inheritance tax will be reduced by twenty percent.

619 a law which will phase out inheritance taxes at a rate of 20 per year and completely eliminate the tax by January 1st 2025. Brothers and sisters half-brother and sisters and sons and daughters-in-law pay 4 on the first 12500. With passage of the new bill if one were to pass away in 2021 the inheritance tax imposed on the inheritor would be reduced by 20 from the original rates.

IA 8864 Biodiesel Blended Fuel Tax Credit 41-149. In 2022 the tax rates listed below will be reduced by 40. Xje3d4vd9esx0m Learn About Sales.

There is no federal inheritance tax but there is a federal estate tax. 50001-100K has an Iowa inheritance tax rate of 12. 100001 plus has an Iowa inheritance tax rate of 15 Note that the tax rates have changed since the new law was passed in 2021.

The tax clearance releases the property from the inheritance tax lien and permits the estate to be closed. Learn About Sales. Get Access to the Largest Online Library of Legal Forms for Any State.

For persons dying in the year 2023 the Iowa inheritance tax will be reduced by sixty percent. In 2020 federal estate tax generally applies to assets over 1158 million. 0-50K has an Iowa inheritance tax rate of 10.

The listed situations and the applicable tax rate range include. Brothers and sisters of the deceased or a son-in-law or daughter-in-law 50 to 100. The federal estate tax exemption increased to 1170 million for deaths in 2021 and 1206 million for deaths in 2022.

For persons dying in the year 2022 the Iowa inheritance tax will be reduced by forty percent. Jan 19 2021 Returns as of 07232022. For deaths occurring on or after.

Inheritance tax in Iowa is based on the heirs relationship with the deceased. For more on beneficiary designation visit this article. Iowa inheritance tax rates If you are the descendants brother sister half-brother half-sister son-in-law or daughter-in-law you will pay tax rates ranging from 4 on the first 12500 of inheritance up to 8 on the value of inheritances worth more than 150000.

The legislation also removes revenue triggers implemented in the 2018 tax reform law to further drop the income tax rates on January 1 2023 with the top rate dropping from 853 percent. Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. Unrelated individuals 100 to 150.

View Our Services. Up to 25 cash back For deaths in 2021-2024 Iowa will reduce the estate tax rate by an additional 20 each year until the tax is fully phased out. The tax rates applicable to inheritances that are subject to the Iowa inheritance tax vary.

Track or File Rent Reimbursement. Learn About Property Tax. Change or Cancel a Permit.

The percentage increases as the. File a W-2 or 1099. The rate is determined by the amount of the inheritance received and range from anywhere between 5 and 15.

Adopted and Filed Rules. How Much Will I pay in Iowa Inheritance Tax New Tax Rates. In 2022 federal estate tax generally applies to assets over 1206 million and the estate tax rate ranges from 18 to 40.

Read more about Inheritance Tax Rates Schedule. DES MOINES Iowa The Iowa Senate on Wednesday passed 46 to 0 SF 576 a bill that repeals Iowas inheritance tax and state qualified use inheritance tax. A business or other for-profit organization 200.

On May 19th 2021 the Iowa Legislature similarly passed SF. The applicable tax rates will be reduced an additional 20 for each of the following three years. Iowa Inheritance and Gift Tax.

In 2023 the tax rates below will be reduced by 60. For more information on the limitations of the inheritance tax clearance see Iowa Administrative Code rule70186122. What is the federal inheritance tax rate for 2020.

Iowa has an inheritance tax but in 2021 the state decided it would repeal this tax by 2025. 619 Iowa will phase out its inheritance tax on property passing from the estate of a decedent dying in 2021 through 2024 with full repeal of the inheritance tax becoming effective for decedents dying on or after Jan. Property inherited by a spouse parent grandparent child grandchild or other direct lineal descendent is exempt from Iowas inheritance tax.

If the net value of the decedents estate is less than 25000 then no tax is applied. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

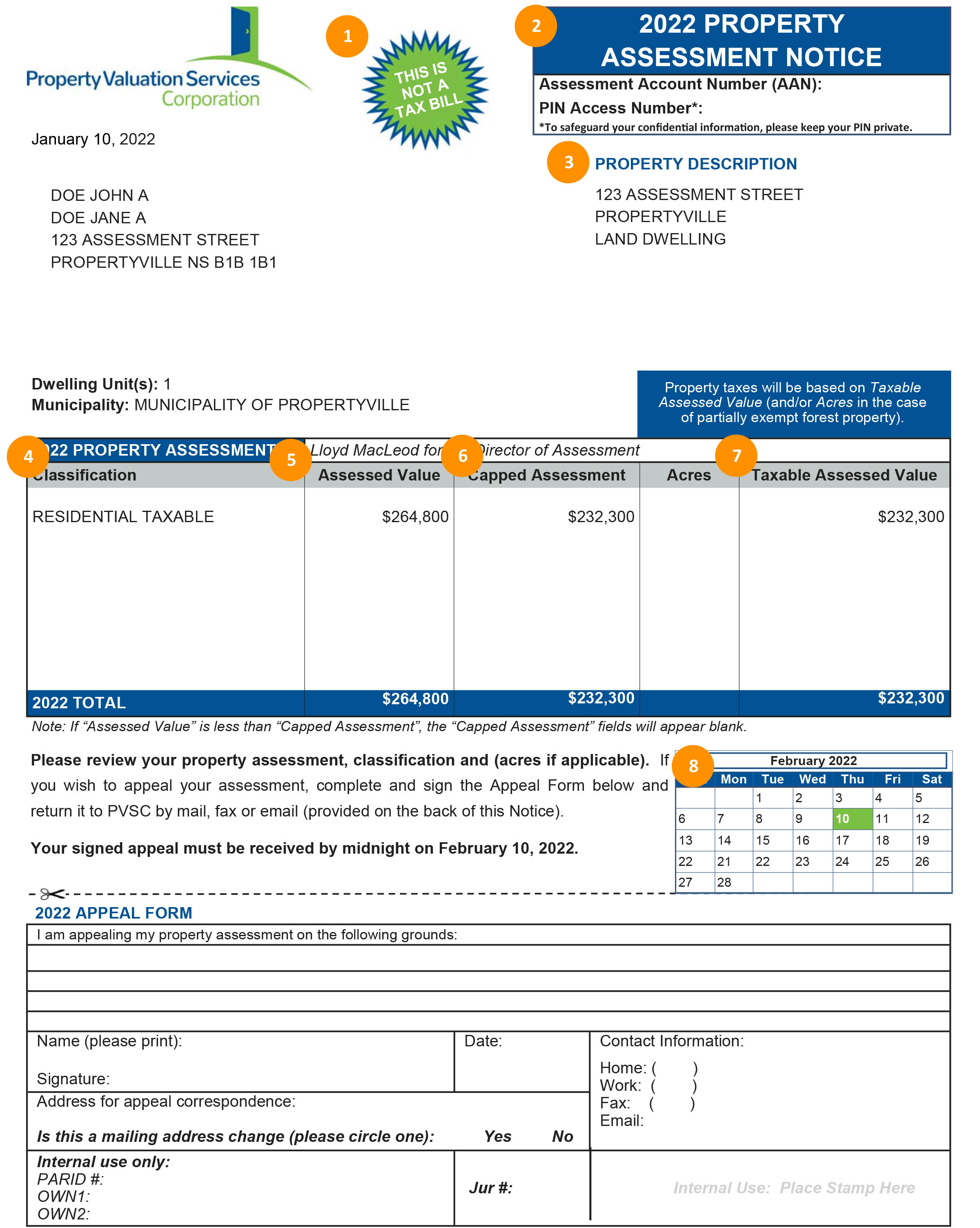

Your Property Assessment Notice Property Valuation Services Corporation

Perks Of Being A Home Owner Real Estate Tips Home Ownership Being A Landlord

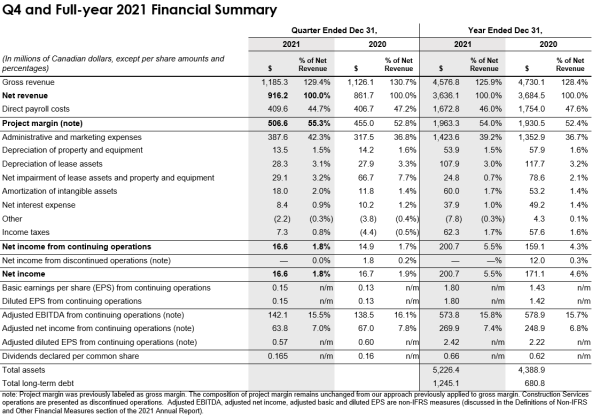

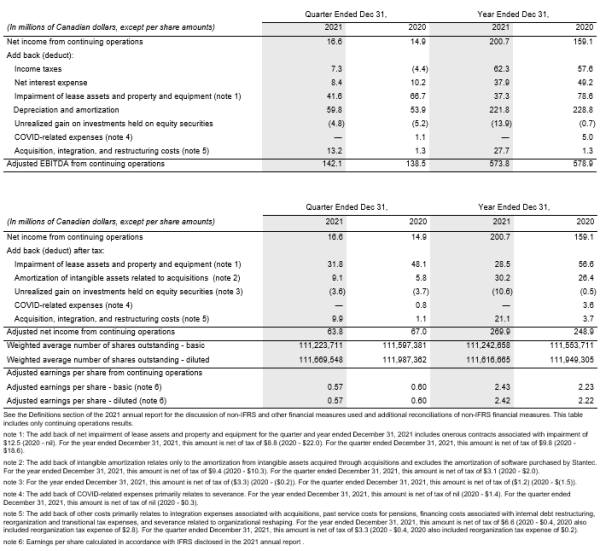

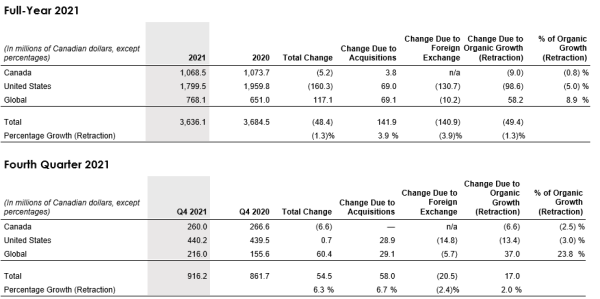

Stantec Reports Record 2021 Earnings Raises Annualized Dividend By 9 1 And Provides 2022 Outlook

Stantec Reports Record 2021 Earnings Raises Annualized Dividend By 9 1 And Provides 2022 Outlook

Rental Property Management Tips And Tricks From The Experts Rental Property Management Rent Prices Being A Landlord

Landlording Rental Properties Blog Posts Biggerpockets Lease Option Being A Landlord Lease

Iowa Estate Tax Everything You Need To Know Smartasset

Whitest States In The United States For 2022

Recent Changes To Iowa Estate Tax 2022

Recent Changes To Iowa Estate Tax 2022

Quebec Income Calculator 2020 2021

Your Property Assessment Notice Property Valuation Services Corporation

Here S How Rising Inflation May Affect Your 2021 Tax Bill

Stantec Reports Record 2021 Earnings Raises Annualized Dividend By 9 1 And Provides 2022 Outlook

Iowa State 2022 Taxes Forbes Advisor

Iowa Estate Tax Everything You Need To Know Smartasset

Claiming Carrying Charges And Interest Expenses 2022 Turbotax Canada Tips